Launch in 2011, Orange Money had explosive success in Cameroon. With 4.5 million users in the country, and a market share of 40.3%, the mobile money transfer service of the Cameroonian subsidiary of Orange is looking for ways to make its service more attractive to its current users, and users to be. That is why this 24th of May, they launched Flash pay, a new and faster method to pay with Orange Money.

With Flash Pay, Orange wants to give its users an alternative to USSD codes (you know the #123#?), and to be honest, it was about time! Unstructured Supplementary Service Data came in handy for telecom operators in Africa to hit a mass market. Compatible with 99.99% of phones and independent of an internet connection, all Cameroonians could have access to whatever service operators wanted to offer (balance consultation, service subscription, etc.). However let’s be honest, entering multiple numbers, in multiple steps to initiate a payment had nothing pleasant. Typing #150#, type 1, 1 again, enter the amount to be transferred, enter your secret code and finally type 1 to confirm (again) was rather frustrating, especially if you had to make payments a couple of times a day. Plus USSD was not the most secured, and could easily fail if the network was congested.

With Flash Pay, bye bye USSD and welcome NFC. Standing for Near Field Communication, NFC is actually a microchip that permits two devices to communicate information when brought close together (10cm maximum). That is the technology exploited by Flash Pay. In this case, Flash Pay is a tag whose assigned function is to initiate payments. This technology is already widely used in the West and East Asia where smartphones are used to pay for goods (using either Google Pay, Samsung Pay or Apple Pay, etc.). The difference being that these smartphones natively embarks NFC chips (most smartphones nowadays integrate those).

Flash Pay is in two variants: a sticker and a bracelet. The sticker sticks to the back of your smartphone, and the bracelet is worn on your wrist (the sticker probably is the best option in this case). To initiate a payment, simply bring the sticker on your smartphone (or bracelet) to the terminal. The sticker/bracelet will act as the active chip (transfers the data), while the terminal will have the passive chip (receives the data). The terminal will automatically prompt you to enter your secret code and you confirm the payment and voila!

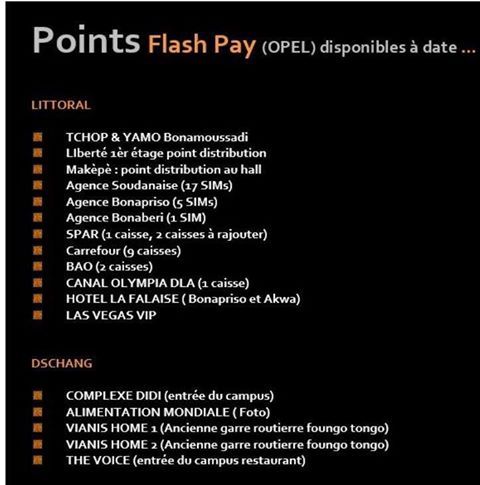

The sticker and the bracelet are both free, and setting them is pretty fast. This method is pretty secure as each microchip contains each user’s unique data (and the distance over which these data are communicated is very short). During my interview with Orange Cameroon, they mentioned the service is now only available in two towns in the country: Douala and Dschang. TCHOP & YAMO, SPAR, and Canal Olympia among others being the commerce that accepts the new payment method. Yaoundé will soon follow the list of compatible towns. Orange Money being widely used in the country daily (they registered 334.8XAF billions of transactions last year), it was about time they render their service faster and more efficient - especially in an era where mobile money becomes more and more democratic. Despite Orange Cameroon's numerous flaws, this is a feature I absolutely welcome!

![[Tutorial]Here Is How I Link My Phone and PC](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg5rJkBYJJMClrUv9bUbfz4vcSLN6VBNunlZf42iTtBoAoRK4IE05SG3kPYWu2dTFpzCW1sElKDQwRHOa7P7fWAUBh9M0IrQSITv2GpVj_7TxXyD4YD-kyLMR9gScbSIrCCQVhUgqgKloE/s72-c/ezgif.com-webp-to-jpg+%25284%2529.jpg)

No comments:

Post a Comment